Efficient Frontier Workflow Notebook - Execution Ready¶

Workflow Notebook¶

This is a compact notebook for headless execution. Supporting notebooks with exploratory notes is here

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import quandl

import scipy.optimize as sco

plt.style.use('fivethirtyeight')

np.random.seed(777)

%matplotlib inline

%config InlineBackend.figure_format = 'retina'quandl.ApiConfig.api_key = 'zCYyKsBbzk94ye5yRjvs'

stocks = ['AAPL','AMZN','GOOGL','FB']

data = quandl.get_table('WIKI/PRICES', ticker = stocks,

qopts = { 'columns': ['date', 'ticker', 'adj_close'] },

date = { 'gte': '2016-1-1', 'lte': '2017-12-31' }, paginate=True)

data.head()Loading...

df = data.set_index('date')

df.head()Loading...

table = df.pivot(columns='ticker')

# By specifying col[1] in below list comprehension

# You can select the stock names under multi-level column

table.columns = [col[1] for col in table.columns]

table.head(10)Loading...

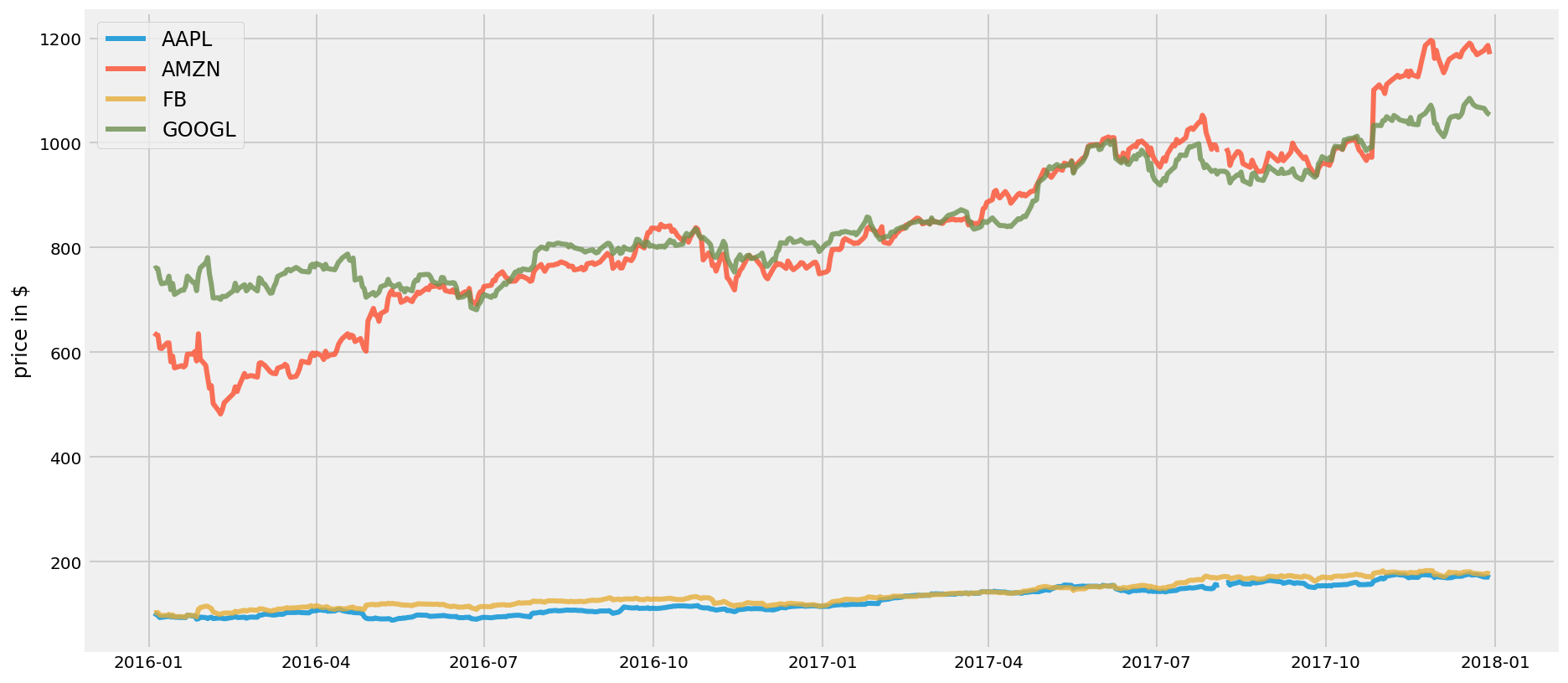

plt.figure(figsize=(14, 7))

for c in table.columns.values:

plt.plot(table.index, table[c], lw=3, alpha=0.8,label=c)

plt.legend(loc='upper left', fontsize=12)

plt.ylabel('price in $')Text(0, 0.5, 'price in $')

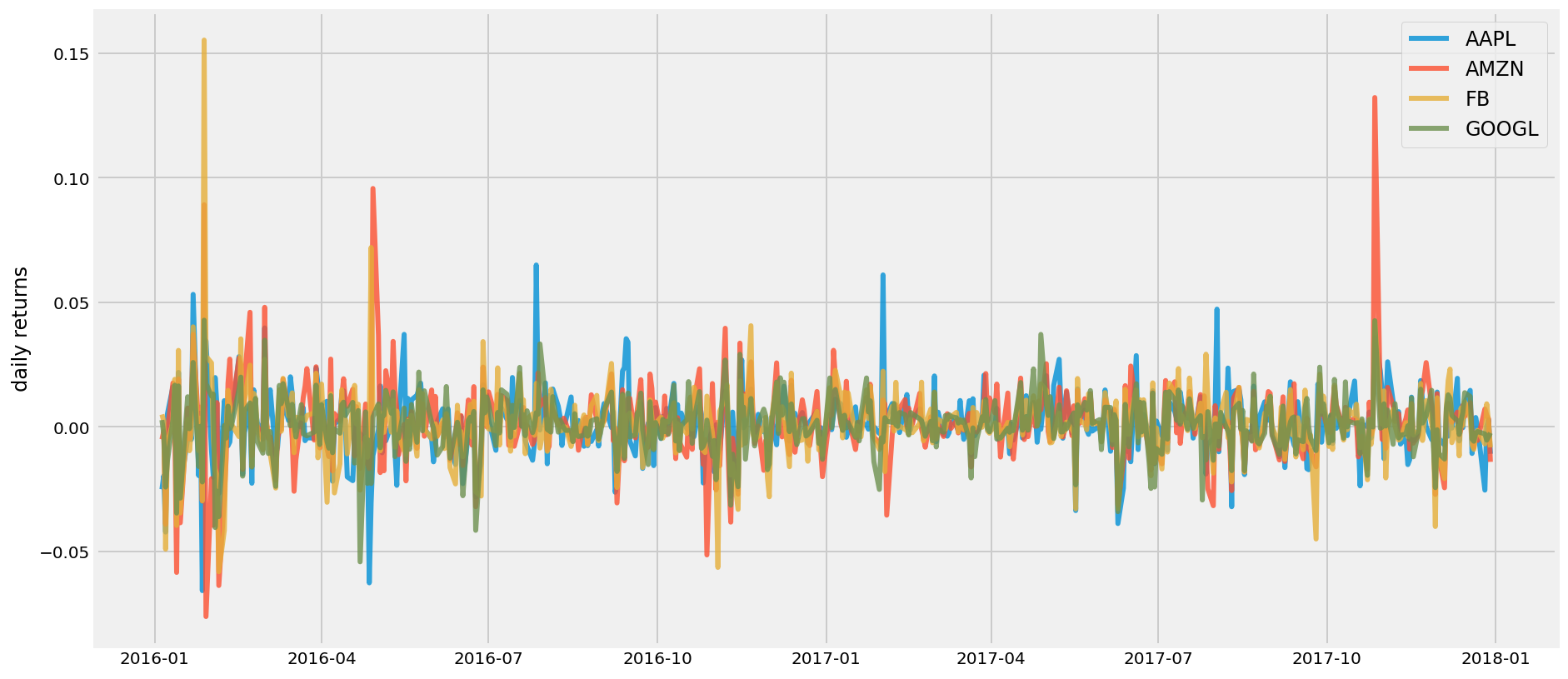

returns = table.pct_change()

plt.figure(figsize=(14, 7))

for c in returns.columns.values:

plt.plot(returns.index, returns[c], lw=3, alpha=0.8,label=c)

plt.legend(loc='upper right', fontsize=12)

plt.ylabel('daily returns')Text(0, 0.5, 'daily returns')

def portfolio_annualised_performance(weights, mean_returns, cov_matrix):

returns = np.sum(mean_returns*weights ) *252

std = np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights))) * np.sqrt(252)

return std, returnsdef random_portfolios(num_portfolios, mean_returns, cov_matrix, risk_free_rate):

results = np.zeros((3,num_portfolios))

weights_record = []

for i in range(num_portfolios):

weights = np.random.random(4)

weights /= np.sum(weights)

weights_record.append(weights)

portfolio_std_dev, portfolio_return = portfolio_annualised_performance(weights, mean_returns, cov_matrix)

results[0,i] = portfolio_std_dev

results[1,i] = portfolio_return

results[2,i] = (portfolio_return - risk_free_rate) / portfolio_std_dev

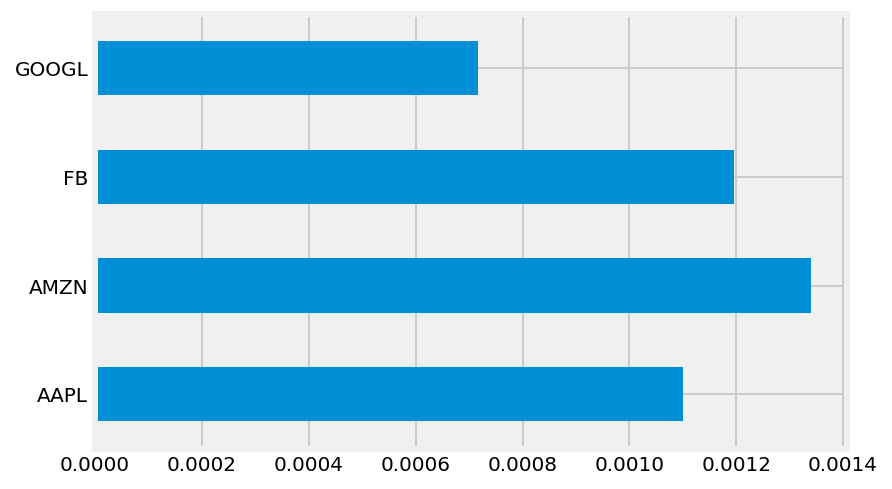

return results, weights_recordreturns = table.pct_change()

mean_returns = returns.mean()

cov_matrix = returns.cov()

num_portfolios = 25000

risk_free_rate = 0.0178mean_returns.plot.barh()<AxesSubplot:>

cov_matrixLoading...

def neg_sharpe_ratio(weights, mean_returns, cov_matrix, risk_free_rate):

p_var, p_ret = portfolio_annualised_performance(weights, mean_returns, cov_matrix)

return -(p_ret - risk_free_rate) / p_var

def max_sharpe_ratio(mean_returns, cov_matrix, risk_free_rate):

num_assets = len(mean_returns)

args = (mean_returns, cov_matrix, risk_free_rate)

constraints = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1})

bound = (0.0,1.0)

bounds = tuple(bound for asset in range(num_assets))

result = sco.minimize(neg_sharpe_ratio, num_assets*[1./num_assets,], args=args,

method='SLSQP', bounds=bounds, constraints=constraints)

return resultdef portfolio_volatility(weights, mean_returns, cov_matrix):

return portfolio_annualised_performance(weights, mean_returns, cov_matrix)[0]

def min_variance(mean_returns, cov_matrix):

num_assets = len(mean_returns)

args = (mean_returns, cov_matrix)

constraints = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1})

bound = (0.0,1.0)

bounds = tuple(bound for asset in range(num_assets))

result = sco.minimize(portfolio_volatility, num_assets*[1./num_assets,], args=args,

method='SLSQP', bounds=bounds, constraints=constraints)

return resultdef efficient_return(mean_returns, cov_matrix, target):

num_assets = len(mean_returns)

args = (mean_returns, cov_matrix)

def portfolio_return(weights):

return portfolio_annualised_performance(weights, mean_returns, cov_matrix)[1]

constraints = ({'type': 'eq', 'fun': lambda x: portfolio_return(x) - target},

{'type': 'eq', 'fun': lambda x: np.sum(x) - 1})

bounds = tuple((0,1) for asset in range(num_assets))

result = sco.minimize(portfolio_volatility, num_assets*[1./num_assets,], args=args, method='SLSQP', bounds=bounds, constraints=constraints)

return result

def efficient_frontier(mean_returns, cov_matrix, returns_range):

efficients = []

for ret in returns_range:

efficients.append(efficient_return(mean_returns, cov_matrix, ret))

return efficientsdef display_calculated_ef_with_random(mean_returns, cov_matrix, num_portfolios, risk_free_rate):

results, _ = random_portfolios(num_portfolios,mean_returns, cov_matrix, risk_free_rate)

max_sharpe = max_sharpe_ratio(mean_returns, cov_matrix, risk_free_rate)

sdp, rp = portfolio_annualised_performance(max_sharpe['x'], mean_returns, cov_matrix)

max_sharpe_allocation = pd.DataFrame(max_sharpe.x,index=table.columns,columns=['allocation'])

max_sharpe_allocation.allocation = [round(i*100,2)for i in max_sharpe_allocation.allocation]

max_sharpe_allocation = max_sharpe_allocation.T

max_sharpe_allocation

min_vol = min_variance(mean_returns, cov_matrix)

sdp_min, rp_min = portfolio_annualised_performance(min_vol['x'], mean_returns, cov_matrix)

min_vol_allocation = pd.DataFrame(min_vol.x,index=table.columns,columns=['allocation'])

min_vol_allocation.allocation = [round(i*100,2)for i in min_vol_allocation.allocation]

min_vol_allocation = min_vol_allocation.T

print("-"*80)

print("Maximum Sharpe Ratio Portfolio Allocation\n")

print("Annualised Return:", round(rp,2))

print("Annualised Volatility:", round(sdp,2))

print("\n")

print(max_sharpe_allocation)

print("-"*80)

print("Minimum Volatility Portfolio Allocation\n")

print("Annualised Return:", round(rp_min,2))

print("Annualised Volatility:", round(sdp_min,2))

print("\n")

print(min_vol_allocation)

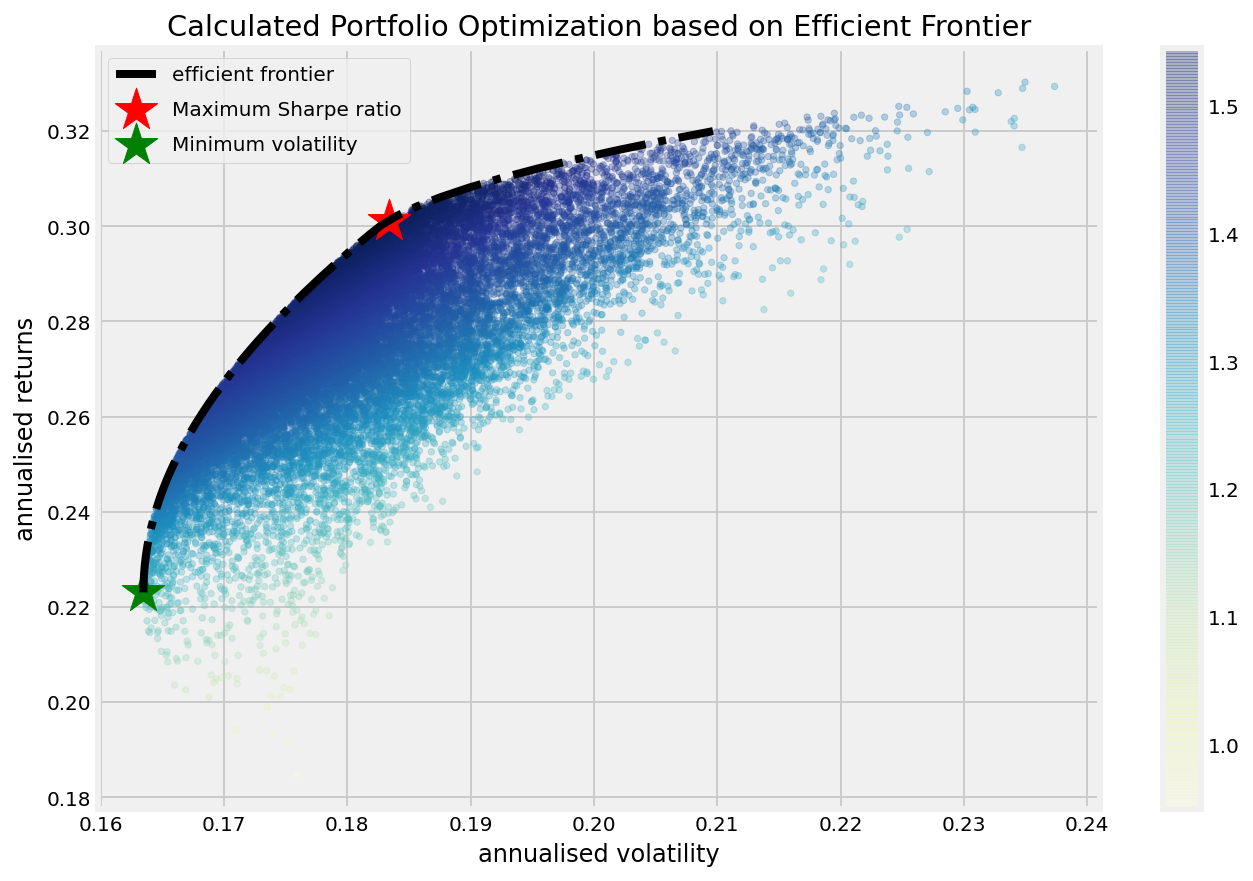

plt.figure(figsize=(10, 7))

plt.scatter(results[0,:],results[1,:],c=results[2,:],cmap='YlGnBu', marker='o', s=10, alpha=0.3)

plt.colorbar()

plt.scatter(sdp,rp,marker='*',color='r',s=500, label='Maximum Sharpe ratio')

plt.scatter(sdp_min,rp_min,marker='*',color='g',s=500, label='Minimum volatility')

target = np.linspace(rp_min, 0.32, 50)

efficient_portfolios = efficient_frontier(mean_returns, cov_matrix, target)

plt.plot([p['fun'] for p in efficient_portfolios], target, linestyle='-.', color='black', label='efficient frontier')

plt.title('Calculated Portfolio Optimization based on Efficient Frontier')

plt.xlabel('annualised volatility')

plt.ylabel('annualised returns')

plt.legend(labelspacing=0.8)display_calculated_ef_with_random(mean_returns, cov_matrix, num_portfolios, risk_free_rate)--------------------------------------------------------------------------------

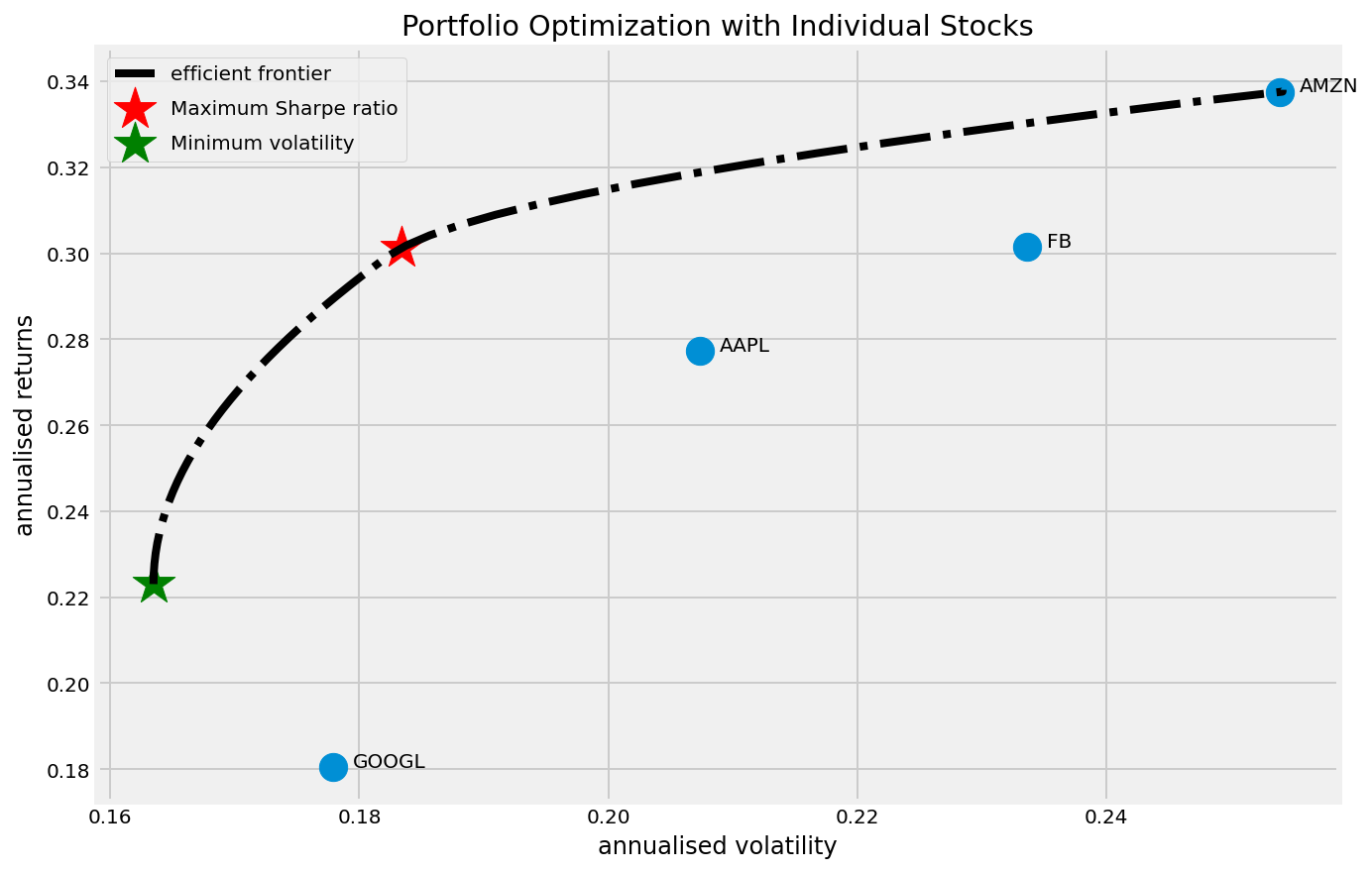

Maximum Sharpe Ratio Portfolio Allocation

Annualised Return: 0.3

Annualised Volatility: 0.18

AAPL AMZN FB GOOGL

allocation 44.67 29.05 26.28 0.0

--------------------------------------------------------------------------------

Minimum Volatility Portfolio Allocation

Annualised Return: 0.22

Annualised Volatility: 0.16

AAPL AMZN FB GOOGL

allocation 34.02 0.73 6.98 58.26

def display_ef_with_selected(mean_returns, cov_matrix, risk_free_rate):

max_sharpe = max_sharpe_ratio(mean_returns, cov_matrix, risk_free_rate)

sdp, rp = portfolio_annualised_performance(max_sharpe['x'], mean_returns, cov_matrix)

max_sharpe_allocation = pd.DataFrame(max_sharpe.x,index=table.columns,columns=['allocation'])

max_sharpe_allocation.allocation = [round(i*100,2)for i in max_sharpe_allocation.allocation]

max_sharpe_allocation = max_sharpe_allocation.T

max_sharpe_allocation

min_vol = min_variance(mean_returns, cov_matrix)

sdp_min, rp_min = portfolio_annualised_performance(min_vol['x'], mean_returns, cov_matrix)

min_vol_allocation = pd.DataFrame(min_vol.x,index=table.columns,columns=['allocation'])

min_vol_allocation.allocation = [round(i*100,2)for i in min_vol_allocation.allocation]

min_vol_allocation = min_vol_allocation.T

an_vol = np.std(returns) * np.sqrt(252)

an_rt = mean_returns * 252

print("-"*80)

print("Maximum Sharpe Ratio Portfolio Allocation\n")

print("Annualised Return:", round(rp,2))

print("Annualised Volatility:", round(sdp,2))

print("\n")

print(max_sharpe_allocation)

print("-"*80)

print("Minimum Volatility Portfolio Allocation\n")

print("Annualised Return:", round(rp_min,2))

print("Annualised Volatility:", round(sdp_min,2))

print("\n")

print(min_vol_allocation)

print("-"*80)

print("Individual Stock Returns and Volatility\n")

for i, txt in enumerate(table.columns):

print(txt,":","annuaised return",round(an_rt[i],2),", annualised volatility:",round(an_vol[i],2))

print("-"*80)

fig, ax = plt.subplots(figsize=(10, 7))

ax.scatter(an_vol,an_rt,marker='o',s=200)

for i, txt in enumerate(table.columns):

ax.annotate(txt, (an_vol[i],an_rt[i]), xytext=(10,0), textcoords='offset points')

ax.scatter(sdp,rp,marker='*',color='r',s=500, label='Maximum Sharpe ratio')

ax.scatter(sdp_min,rp_min,marker='*',color='g',s=500, label='Minimum volatility')

target = np.linspace(rp_min, 0.34, 50)

efficient_portfolios = efficient_frontier(mean_returns, cov_matrix, target)

ax.plot([p['fun'] for p in efficient_portfolios], target, linestyle='-.', color='black', label='efficient frontier')

ax.set_title('Portfolio Optimization with Individual Stocks')

ax.set_xlabel('annualised volatility')

ax.set_ylabel('annualised returns')

ax.legend(labelspacing=0.8)display_ef_with_selected(mean_returns, cov_matrix, risk_free_rate)--------------------------------------------------------------------------------

Maximum Sharpe Ratio Portfolio Allocation

Annualised Return: 0.3

Annualised Volatility: 0.18

AAPL AMZN FB GOOGL

allocation 44.67 29.05 26.28 0.0

--------------------------------------------------------------------------------

Minimum Volatility Portfolio Allocation

Annualised Return: 0.22

Annualised Volatility: 0.16

AAPL AMZN FB GOOGL

allocation 34.02 0.73 6.98 58.26

--------------------------------------------------------------------------------

Individual Stock Returns and Volatility

AAPL : annuaised return 0.28 , annualised volatility: 0.21

AMZN : annuaised return 0.34 , annualised volatility: 0.25

FB : annuaised return 0.3 , annualised volatility: 0.23

GOOGL : annuaised return 0.18 , annualised volatility: 0.18

--------------------------------------------------------------------------------